In today rapidly changing financial landscape understanding Jio Finance Share the latest trends and developments in the market is essential for investors.

One such development that has garnered considerable attention is the rise of Jio Finance Share. As an investor or financial enthusiast you might be wondering what makes Jio Finance Share stand out in the current market.

What is Jio Finance?

Before diving deep into Jio Finance Share it’s essential to understand what Jio Finance is and how it operates within the broader financial ecosystem.

Jio Finance is part of the Jio Group, which is one of India’s most prominent telecommunications and technology conglomerates.

The company has ventured into various sectors, including finance, banking, and investment services. Through Jio Finance the company seeks to provide innovative financial solutions to a wide range of consumers, businesses, and investors across India.

It is expected that Jio Finance will revolutionize financial services by leveraging technology, offering digital-first solutions, and simplifying the access to financial products.

Jio Finance offers various services including digital lending, investment management, insurance, and payment solutions.

Its objective is to bring financial inclusion to millions of people across the country, especially those who have previously been underserved by traditional banking channels.

The Rise of Jio Finance Share

Over the past few years, Jio Finance Share has been making waves in the Indian financial market. As part of its broader expansion strategy Jio has entered the finance sector with a clear goal of capturing a substantial market share.

The company’s decision to offer financial products and services to a wider audience has resulted in an increasing demand for Jio Finance Shares.

The growth of Jio Finance Share is largely driven by the company’s technological innovation, market penetration, and the increasing demand for digital financial services in India.

Jio has become a household name due to its affordable telecommunications services, and now, the company is leveraging its strong brand presence to penetrate the finance sector.

Key Factors Driving Jio Finance Share Growth

Several key factors contribute to the growth of Jio Finance Share and its prominence in the market:

1. Technological Innovation

Jio has always been at the forefront of technological advancements, and its entry into the financial sector is no exception.

The company is utilizing advanced technologies like artificial intelligence, machine learning, and blockchain to enhance its financial products and services.

By offering a seamless, tech-driven experience, Jio Finance is attracting a new generation of investors who value ease of access and transparency.

2. Financial Inclusion

India has a large unbanked and underbanked population, and Jio Finance aims to bridge this gap. By offering accessible financial products to people from all walks of life, Jio is tapping into a vast market that was previously underserved.

The company’s emphasis on financial inclusion is one of the primary reasons why Jio Finance Share has become increasingly attractive to investors.

3. Strategic Partnerships

Jio Finance has formed strategic partnerships with several leading financial institutions to expand its reach and enhance its product offerings.

These collaborations help Jio Finance provide comprehensive financial solutions, including digital loans, insurance, and investment options.

4. Customer-Centric Approach

One of the key elements driving Jio’s success in the financial sector is its customer-centric approach. The company focuses on providing personalized financial services that cater to the unique needs of its clients.

Whether it’s offering microloans to individuals or helping small businesses with working capital, Jio Finance aims to empower its customers and foster financial independence.

5. Government Initiatives and Support

The Indian government has been actively promoting digital financial inclusion and fintech innovation through various initiatives.

Jio Finance is well-positioned to capitalize on these government policies, which are aimed at boosting the adoption of digital financial services.

Why Should You Consider Investing in Jio Finance Share?

As an investor, you might be wondering whether investing in Jio Finance Share is a good idea. Let’s explore the reasons why this stock may be a valuable addition to your portfolio.

1. Strong Market Presence

Jio is one of the largest telecommunications companies in India, with millions of subscribers across the country.

As a result, Jio Finance Share has the potential to benefit from Jio’s established market presence and loyal customer base.

2. Potential for High Returns

Given the rapid growth of digital financial services in India and Jio’s ability to tap into this emerging market, Jio Finance Share has the potential for high returns.

As more people adopt digital banking and financial services, Jio Finance is poised for significant growth, which could translate into higher stock value.

3. Diversification

Investing in Jio Finance Share offers diversification to your investment portfolio. Since Jio operates in various sectors such as telecommunications, technology, and finance, owning Jio Finance shares gives you exposure to multiple industries. This can help mitigate risks and provide stable returns in the long run.

4. Sustainability and Long-Term Growth

Jio Finance has a clear vision of promoting financial inclusion and offering sustainable financial products. Investors looking for sustainable growth opportunities will find Jio Finance to be an appealing option.

5. Strong Leadership and Vision

Jio’s parent company, Reliance Industries, is led by one of India’s most visionary leaders, Mukesh Ambani.

His leadership and strategic vision have been key to Jio’s success in the telecommunications sector, and this vision is expected to drive the company’s success in the financial services industry as well.

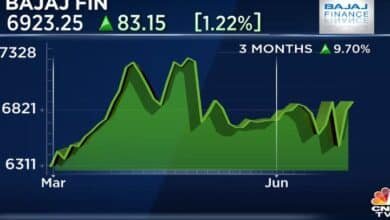

Also Read: Muthoot Finance Share Price

Risks Involved with Investing in Jio Finance Share

While Jio Finance Shares holds great promise, it’s essential to understand the risks involved in investing in the stock market.

Like any other stock, Jio Finance is subject to market fluctuations and economic conditions. Additionally, the company is operating in a competitive market, with other players also vying for a share of the financial services market.

Investors should conduct thorough research and consider consulting with a financial advisor before making investment decisions regarding Jio Finance Shares.

Risk management strategies, such as diversification, can help mitigate potential losses and ensure that your portfolio remains balanced.

Final Thoughts Of Jio Finance Share

Jio Finance Sharesis undoubtedly one of the most exciting investment opportunities in the Indian market today.

The company’s innovative approach to financial services, its commitment to financial inclusion, and its strong brand presence make it an attractive option for both seasoned and new investors.

As the digital financial services sector continues to grow in India, Jio Finance is poised to play a significant role in shaping the future of the industry.

By understanding the factors driving Jio Finance Shares growth and evaluating the potential risks, you can make an informed decision about investing in this promising stock

. As with any investment, it is crucial to stay updated on market trends and conduct thorough research to ensure that your investment strategy aligns with your financial goals.

In conclusion, Jio Finance Shares represents an exciting opportunity for investors looking to tap into India’s rapidly evolving financial sector.